closed end credit vs open

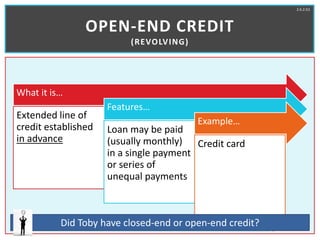

Open-end credit is an account you can continually draw from as needed and only pay interest on the amount you borrow. A line of credit is a type of.

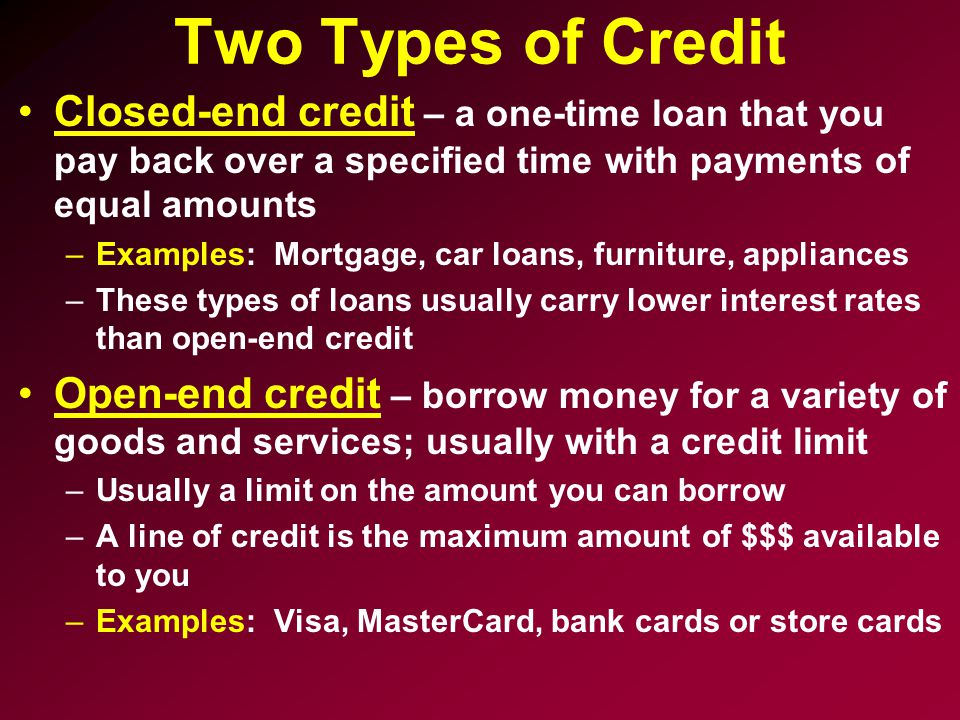

Closed-end credit usually has a lower interest rate than open-end credit.

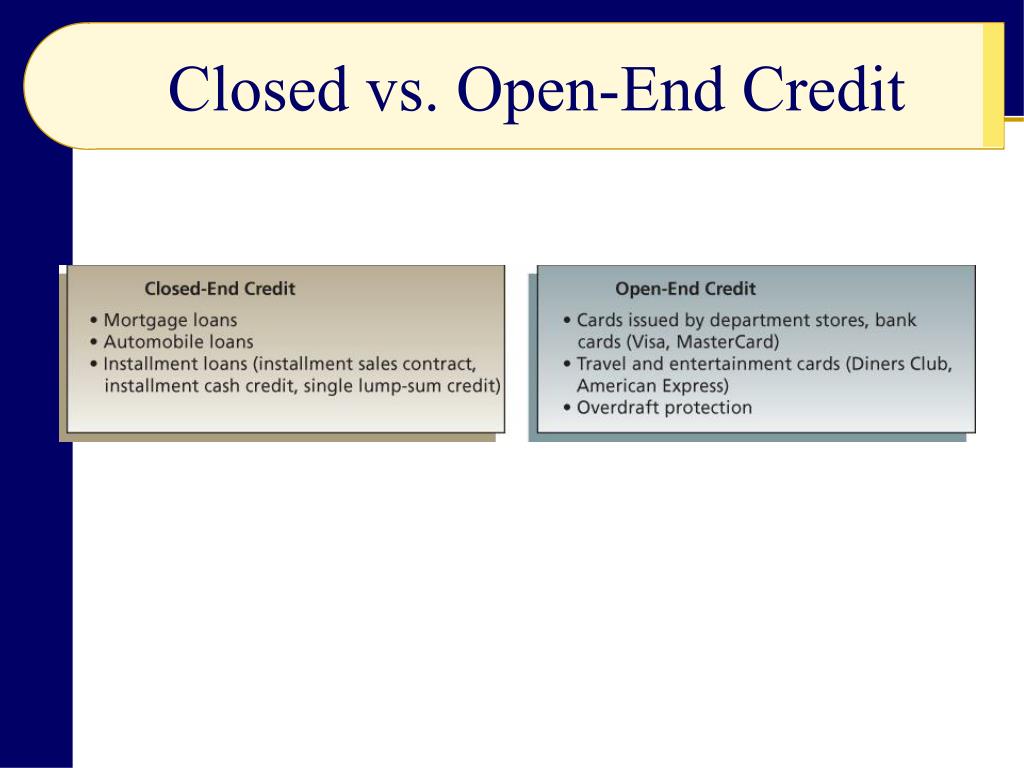

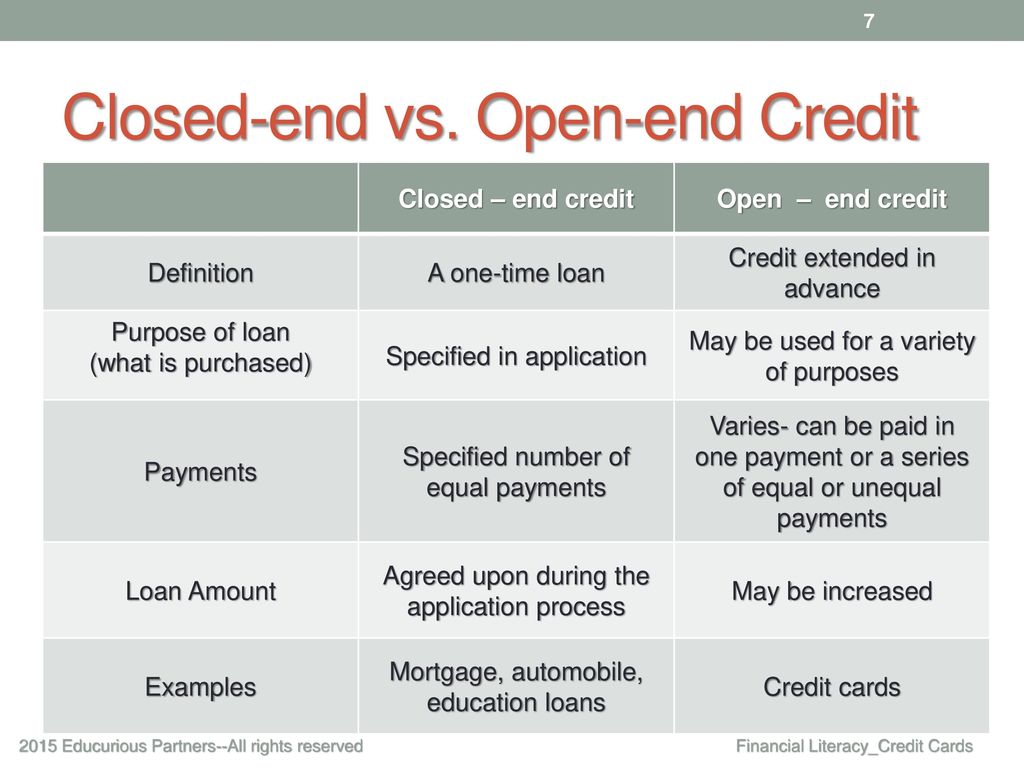

. Though you pay interest on. Closed-end credit is a one-time installment loan you usually take out for a specific purpose. With regards to the need a person or company usually takes a form out of credit this is certainly either open- or closed-ended.

The main difference between. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage. Closed-End Credit vs.

You must make payments on the loan until the interest and principal are paid off. Open end loan can be borrowed multiple. In an open-end lease more common in business leasing the person or.

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. In a closed-end lease the leasing company takes on the risk of any additional depreciation. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

Open Type Of Credit. Open-end credit is not restricted to a specific use. Open-end leases and closed-end leases are two different ways of leasing a car.

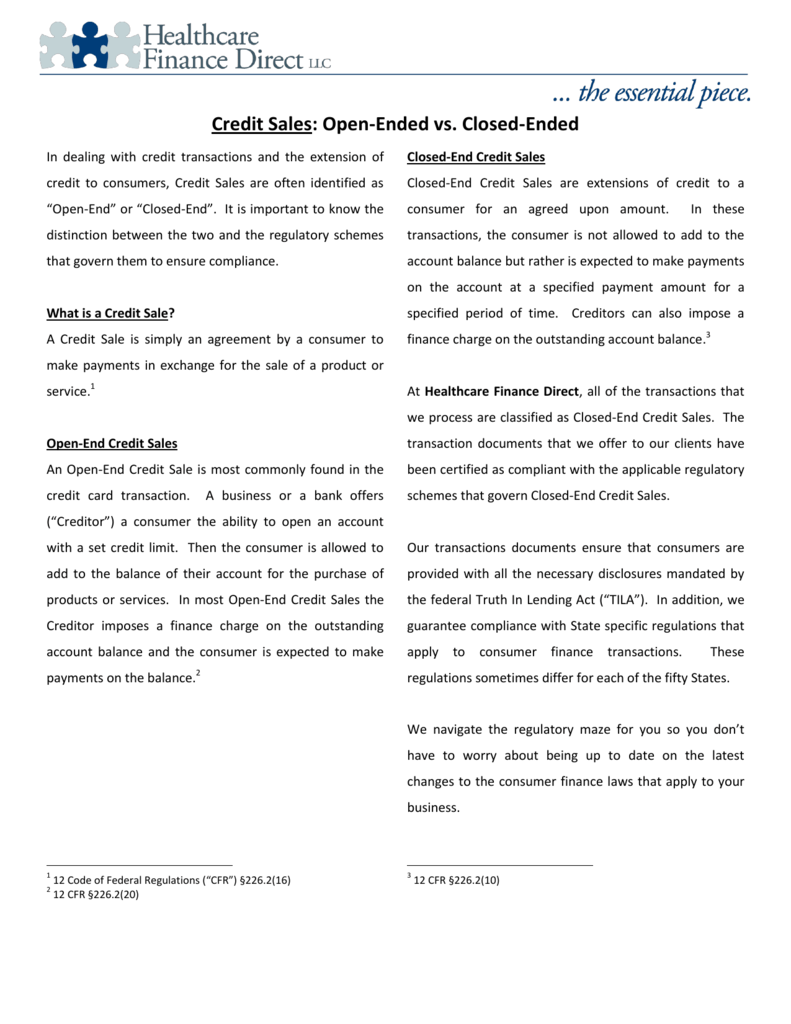

Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all payments have been completed. Lines of credit are different than closed-end loans as we explained previously. Consumer lending products aka consumer loans can be open-end credit or closed-end credit.

The borrower can reuse. With closed end credit you cannot add to what you have borrowed. It remains open and it.

Installment loans including a 144-month auto loan are examples of closed. For example a car company will have a. While both options use the cars residual value to calculate your monthly.

With open-end credit you can keep using the same credit over and over as long as you make the minimum monthly payments on time. However interest is charged on the entire principal amount. With closed-end credit you borrow money once and repay the loan.

The choice of which type of credit to use will ultimately come down to why you need to borrow. Both forms of debt have their advantages and drawbacks. Lines of credit and closed-end loans differ primarily in.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Closed-End Credit vs Open-End CreditResource Multiple Languages. Open End Credit vs.

6 02 Credit Basics Power Point

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Cash 1 Loans Blog News Page 4 Of 34

Mlo Mentor Section 32 Coverage Tests Firsttuesday Journal

Chapter 6 Consumer Credit Ppt Download

What Is Open End Credit Experian

Using A Home Equity Loan For Debt Consolidation

Credit Sales Open Ended Vs Closed Ended

Ppt Chapter 6 Credit Use And Credit Cards Powerpoint Presentation Free Download Id 5727535

What Are Closed End Funds Fidelity

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

Comply Partial Exemption Processing

Closed End Credit Versus Open End Credit 2020 Youtube

Understanding Open End Credit Youtube

Home Equity Loans Decrease Nearly 8 Yoy In Q2 While Credit Quality Improves S P Global Market Intelligence

Understanding Credit Cards Ppt Download

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)